You deserve investment advice and a portfolio that always puts your best interests first. As an independent investment advisor and a legal fiduciary to you, we must only provide advice that is in your best interest. We are not constrained or limited in anyway when making recommendations to you and building your portfolio.

You should consider our growth-oriented Super-Diversified portfolio. It is diversified among 11 distinct asset classes. This portfolio has a risk profile that is similar to a traditional 70% stocks / 30% bonds portfolio. Our Super-Diversified portfolio has a substantially higher expected return than the traditional portfolio due to the added diversification.

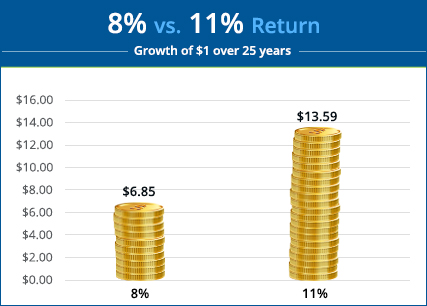

Compound interest is the key to maximizing the growth of capital. Getting an incrementally better return, such as an 11% compounded return as compared to 8%, over many years has a tremendous impact.

Let’s review the power of the Rule of 72. Simply divide 72 by your expected rate of return to see how long it takes for your money to double. For example, a portfolio growing at 8% will double every 9 years (72 divided by 8). Compare this to a portfolio that grows at 11% compounded annually…it will double every 6 ½ years.

Over 25 years, a portfolio growing at 11% as compared to 8% will double nearly one additional time. This means you grow your capital to twice as much as you would otherwise! What appear to be small incremental improvements in returns can make a tremendous difference over time.

Our Super-Diversified Portfolios have proven to deliver better returns and can position you for much more long-term accumulation of wealth.

The following is a hypothetical calculation showing the estimated value of your portfolio assuming the same compounded annual return achieved by our Super-Diversified Growth Model Portfolio as compared to a traditional portfolio of 70% stocks / 30% bonds.

Every investor’s circumstances are different and need to be individual considered. This estimated calculation assumes the compounded annual return of our Super-Diversified Growth Portfolio and a Traditional 70% stocks / 30% bonds portfolio. To determine a portfolio that is right for you, we would need to learn about your investment goals and circumstances.

You should consider our moderate risk Super-Diversified portfolio. It is diversified among 11 distinct asset classes. This portfolio has a risk profile that is similar to a traditional 50% stocks / 50% bonds and cash portfolio. Our Super-Diversified portfolio has a substantially higher expected return than the traditional portfolio due to the added diversification.

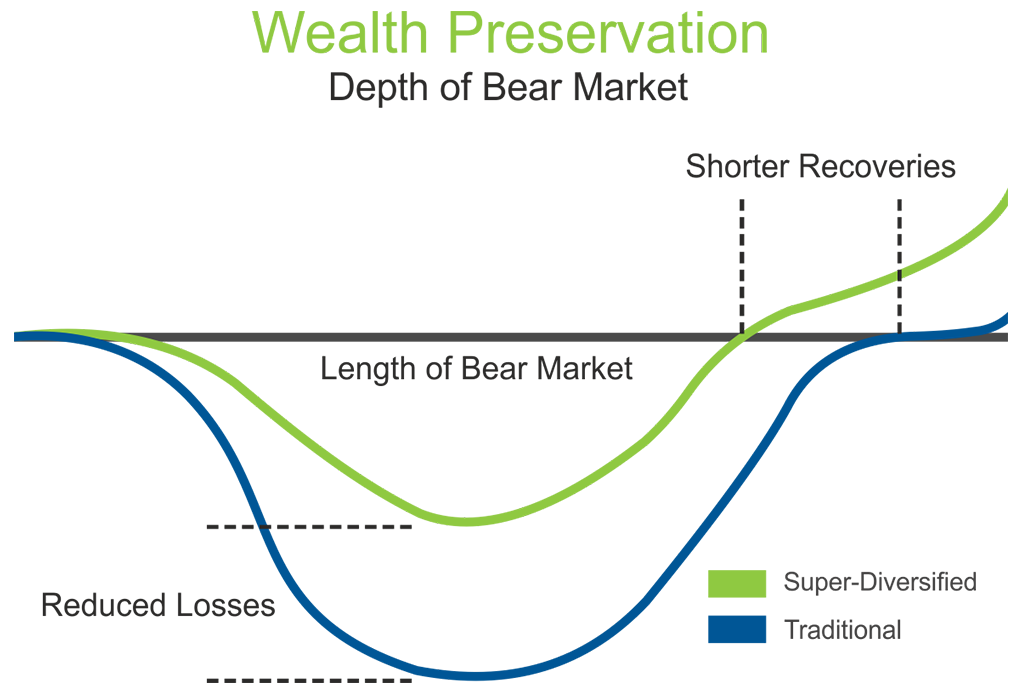

Wealth preservation is a delicate balance between mitigating downside risks while also maintaining reasonable long-term growth. The focus when constructing the appropriate portfolio is on the risks of bear markets and understanding what can be expected during these difficult times.

A Super-Diversified Portfolio, through added diversification, can position a portfolio for meaningfully less expected loss during bear markets and reduced recovery times. Furthermore, expected returns of a Super-Diversified Portfolio remain comparable or higher than a traditional portfolio of stocks, bonds, and cash. That said, you do not want to forgo the opportunity for reasonable long-term growth.

The following is a hypothetical calculation showing the estimated portfolio value loss during the average bear market for our Super-Diversified Moderate Model Portfolio as compared to a traditional portfolio of 50% stocks / 50% bonds and cash.

Every bear market is different but research and actual results show that a Super-Diversified Portfolio positions a portfolio for consistently less loss and shorter recovery times.

You should consider our income-oriented Super-Diversified portfolio. It is diversified among 11 distinct asset classes. This portfolio has a risk profile that is similar to a traditional 25% stocks / 75% bonds and cash portfolio. Our Super-Diversified portfolio has a substantially higher expected return than the traditional portfolio due to the added diversification.

Retirement income is all about taking as much income from your portfolio as you need without taking so much that you risk depleting your portfolio. This is commonly referred to as a “sustainable withdrawal rate” and can be different for every investor depending on your age, income flexibility, and legacy intentions.

A common rule of thumb regarding withdrawal rates is called “The 4% Rule”. This states that you can safely withdrawal 4% of your portfolio annually at the start of retirement and increase it by inflation of 3% per year. This rule assumes your money is invested in a traditional portfolio of stocks and bonds. If you instead invested in our Super-Diversified income-oriented portfolio that has a similar risk profile and higher expected long-term returns, you could instead increase your withdrawal rate to 5% of your portfolio value which would dramatically increase your retirement income with no added risk of depleting your portfolio.

4% is generally believed to be a sustainable withdrawal rate during retirement (withdrawal 4% of your portfolio value annually for income). But a portfolio with added diversification can increase the long-term expected return allowing you to safely withdrawal 5% resulting in 25% more annual income.

The 4% Rule makes many assumptions that could be different than your circumstances and could meaningfully impact your sustainable withdrawal rate. Regardless of your expected or current withdrawal rate, the impact of incrementally better long-term returns during your retirement years can have a tremendous impact on your income during those years.

The following is a hypothetical calculation showing the estimated value of your portfolio assuming the same compounded annual return achieved by our Super-Diversified Income Model Portfolio as compared to a traditional portfolio of 25% stocks / 75% bonds and cash.

Every investor’s circumstances are different and need to be individual considered. This estimated calculation assumes the compounded annual return of our Super-Diversified Income Portfolio and a Traditional 25% stocks / 75% bonds portfolio. To determine a portfolio that is right for you, we would need to learn about your investment goals and circumstances. Future returns are unknown and investors may have to adjust their withdrawal rates accordingly.

Request a custom analysis of your portfolio and see details about the impact Super-Diversification can have on your investment goals.

Learn more about the performance of our Super-Diversification portfolio strategy.

Learn about what makes a Super-Diversified Portfolio different than traditional portfolios.

See how simple it is to take the first step to improving your investment results!

Please login or subscribe to our news letter to access the Exclusive Content.

If you have already subscribed then please enter your Email address

IMPORTANT NOTICE: INFORMATION ABOUT PAST PERFORMANCE

Not indicative of future returns. Past performance is not indicative of future returns, which may vary. Accordingly, future returns are not guaranteed and there can be no assurance that any Patton Fund, Strategy, or Portfolio (“Patton Investments”) will achieve comparable investment results or its investment objective. You may lose money on your investment in a Patton Investment.

Strategy Developed based on Back-testing. The investment strategies used by Patton were developed, in part, by back-testing its investment program against past market and economic conditions. In other words, the strategies were designed to succeed based on knowledge of events that occurred in the past. One limitation of such a strategy is that it is inherently focused on the past, and cannot necessarily take account of market and economic conditions that may arise in the future. If future market and economic conditions are different from past market and economic conditions, and if investors behave differently from past investors, Patton’s investment strategies may not work as anticipated and the Strategy, Fund, or any Patton Investments, may lose money.

Fees and Distributions. The performance information shown reflects the deduction of actual expenses of the applicable Patton Investment for periods during which the Patton Investment has been in operation (see below). The performance figures shown reflect the reinvestment of all dividends, interest and other income, and assume that the applicable Patton Investment has not made any distributions to investors. Estimated fees and expenses including brokerage commissions, borrowing costs, and advisory fees, have been deducted from all back-tested performance.

Portfolio Characteristics. Portfolio characteristics, including specific holdings, contributors to performance, and country, sector and industry exposure, are shown as of the date indicated only, and are subject to change without notice. Portfolio characteristics are designed to illustrate the application of the Patton Investments’ investment style only, and should not be considered a recommendation.

Third Party Information. Information contained herein is based on data obtained from statistical services, company reports or communications, or other sources. Patton Fund Management believes these sources to be reliable. However, we have not verified this information, and we make no representations whatsoever as to its accuracy or completeness.

IMPORTANT NOTICE: INFORMATION ABOUT BACK-TESTED PAST PERFORMANCE

Performance results may be presented that pre-dates the commencement of operations of a Patton Investment Strategy. Because the Patton Investment Strategy was not in operation during certain periods shown, the performance information prior to the date the Patton Investment Strategy commenced operations is back-tested performance (sometimes referred to as hypothetical performance).

Patton Investment Strategies Inception Dates (first full month)

There are several important factors to consider when reviewing back-tested, or hypothetical, performance information:

Back-tested Performance is Hypothetical. The performance information shown for the Patton Investment Strategy you select includes performance information that is hypothetical, and is not real nor based on an actual portfolio managed by Patton. As such, the back-tested portion of the performance presentation does not represent the investment performance or the actual Patton Investment Strategy or any investors in the Patton Investment Strategy. The securities in these hypothetical portfolios were selected with the full benefit of hindsight, after their performance over the period shown was known. It is not likely that similar results could be achieved in the future. The back-tested results may not reflect the impact that any material market or economic factors might have had on the results if the Strategy had been used during the period to actually manage client assets. Furthermore, back-testing does not reflect how Patton actually might have reacted when managing client investments to economic and market events. The hypothetical portfolios presented here are purely illustrative, and representative only of a small sample of possible future scenarios.

Back-testing is Subject to Limitations. While it is believed that back-tested performance information presented is relevant to evaluating an investment in the Patton Investment Strategy, no representation is or could be made that the information presents what the performance results would have been in the past or are likely to be in the future. There are frequently sharp differences between hypothetical performance results and actual performance results subsequently achieved. One limitation of hypothetical performance is that it is generally prepared with the benefit of hindsight. In addition, no hypothetical track record can completely account for the impact of financial risk in actual trading. For example, back-factors that affect markets in general, the impact of fees and expenses, market liquidity and other factors may all have affected actual performance.

Actual Investor Experience Varies. The back-tested results are not indicative of the skill of Patton. For example, each Patton Investment Strategy began trading on the date indicated above. Back-tested performance shown for each Patton Investment Strategy reflects hypothetical performance determined using the current investment strategy of the applicable Patton Investment Strategy. However, Patton has been managing money using quantitative strategies since 2001. During this period Patton has experienced periods of poor performance and Patton has closed other Patton Investment Strategies that it has managed as a result of poor performance. Investors in some of Patton’s closed Strategies (and funds) have lost money.

Back-testing Period. During the back-tested period, Patton was either not providing investment advice or was not providing investment advice according to the Strategy used to calculate the back-tested results.

Indices. The historical performance of various indices, such as the S&P 500 Index, may be included. An index is an unmanaged, broad-based market index and investing in any Patton Investment Strategy is not similar to investing in an index. An index is not available for direct investment, and the securities in an index will not match the Strategy's holdings. In addition, unlike an index, the Strategy's performance will be affected by fees and expenses.

Forward-looking Statements. Any forward-looking statements represent the subjective views of Patton and their validity may be affected by events and conditions not now contemplated and by other factors, many of which may be beyond Patton's control. Actual results may vary and such variations may be material, and no representation or warranty is made regarding any forward-looking information contained herein.

Super-Diversification Flex Growth Strategy

"Patton Clients" is a composite of the actual NET performance (net of all actual management fees, performance fees, transaction costs, custodial fees, and any other expenses) of our clients utilizing our Super-Diversification Flex Growth Strategy totaling approximately $141,271,642 of assets. Generally all portfolios in excess of $100,000 in value and without major restrictions are included in the composite. Portfolios are generally added to the composite for their first full month and removed after their last full month of availability. Our Strategy and process has remained consistent over the entire period. Not all Patton Clients with the same strategy experienced the same performance due primarly to minor differences in allocations, differences in fees and other restrictions and limitations. A very limited number of Patton Clients pay fees from money outside of their portfolio resulting in a higher return. Some clients are Qualified Clients and Accredited Investors as defined by the SEC and may pay a performance-based fee which can meaningfully impact performance. Daily returns are geometrically linked. Returns are gross of taxes.

Use of leverage on a portion of the portfolios represented by this composite return has had a material impact on the performance figures displayed.

Performance includes the reinvestment of dividends and other earnings. Investors may lose money, and are expected to lose money, during significant market declines and other market conditions, in this strategy.

The asset allocation of the strategy has been different than the ARC Private Client Index, resulting in differing performance, although the risk profiles of both have been generally similar. During the period being reported the market has been in an upward trend that has been stronger than historic averages. There is no assurance that this type of trend will persist or how we would perform if it did.

All other representations of Super-Diversification performance throughout our website is back-tested simulated results unless otherwise noted.

ARC Private Client Index

The ARC Private Client Index is an index created by and maintained by the ARC Group. These indexes were selected as comparables because they measure the performance of professionally managed diversified portfolios. These indexes consist of more than 350,000+ actual investor portfolio returns that are managed by 138 investment managers (as of February 2025) including some of the largest in the world. These 138 managers only represent a sample of the 10,000's of investment managers and other such service providers (financial planners, traditional brokers, etc.). Performance is net of fees.

There are 4 Private Client Indexes each with a different risk profile. We have selected for dsiplay the ARC Private Client Index with the most comparable risk profile, Steady Growth (allocation approximately 51.0% equities, 19.7% Fixed Income, 8.5% Cash, and 20.9% Other as of February 2025), to our Patton Clients performance.

For more information about these indexes, visit the ARC Group's website here.

Industry benchmarks presented for comparison to Super-Diversified Portfolios are believed to be comparable risk portfolios although the holdings are very likely significantly different. Simulated portfolio benchmarks, such as a "Traditional Portfolio", does have a similar risk profile but is allocated only to traditional asset classes of stocks, bonds, and cash.

IMPORTANT NOTICE: INFORMATION ABOUT MODEL PORTFOLIO PERFORMANCE

Unless otherwise noted, the performance of all portfolios ("Model Portfolios") are simulations of various combinations of asset classes used to simulate the performance of various types of portfolios with various risk profiles. All Model Portfolios for all time periods are back-tested hypothetical simulated results.

Model Portfolios have been developed based on historical performance of the described indexes for the relevant time period using our proprietary process and do not represent the results of actual trading of investor assets. Model portfolio allocations were selected with the benefit of hindsight. Model performance has inherent limitations. Since these are simulated portfolios (hypothetical) and do not reflect any investor's actual experience with owning, trading or managing an actual investment account, there can be no assurance that an investor would have achieved similar rates of return over the time frame. Thus, the performance shown does not reflect the impact that material economic and market factors (lack of liquidity and other such factors) had or might have had on decision making if actual investor money had been managed. In addition, since the time period in question is a historical one, there can be no assurance that future results achieved by investors will in any way resemble those represented by the Model Portfolios. Model Portfolios are rebalanced monthly. All performance data is total returns which includes interest and dividends. The calculations are net of the estimated management and/or performance fees, trading costs, and fund expense ratios (see below table for estimated expense ratios by Asset Class) if applicable. Performance does not reflect the deduction of other fees or expenses, including but not limited to brokerage account fees, custodial fees, and fees and expenses charged by mutual funds, exchange traded funds, and other investment companies that may be in addition to the expense ratio (these additional expenses tend to be extremely low). Taxes are not considered.

Our presentation of hypothetical model portfolio performance is intended only for website visitors who have the resource and financial expertise to understand the inherent limitations and risks associated with such data.

The following describes how a model portfolio monthly return is calculated:

Model Portfolios presented on our website are portfolios blended from various indexes. The blended asset allocation of every Model Portfolio is readily available within the website. The benchmark index(es) used to represent each asset class is disclosed elsewhere in this disclosure. We do adjust the performance of the benchmark indexes for fees of an applicable fund available to invest in that index or asset class.

When a Model Portfolio's performance is compared to a single benchmark index, such as the S&P 500, the index has not been selected to represent an appropriate benchmark to compare an investor's performance, but rather are disclosed to allow for comparison of the investor's performance, for the convenience of the investor, to that of certain well-known and widely recognized indices. Indices are typically not available for direct investment, are unmanaged, and do not incur fees or expenses.

The goal of a portfolio is not to outperform any single index. The objective of a portfolio is total return. All portfolios are subject to the risk of loss. Patton was not necessarily managing portfolios similar to any given model portfolio. Model Portfolios are not indicative of the skill of Patton nor the performance of portfolios managed by Patton.

The performance calculations of all Model Portfolios have not been audited by any third party. Actual performance of client portfolios may differ materially due to the timing related to additional client deposits or withdrawals and the actual deployment and investment of a client portfolio, the length of time various positions are held, the client’s objectives and restrictions, and fees and expenses incurred by any specific individual portfolio.

Any presentation of two portfolios for comparison is generally intended to have a similar risk profile. Some Model Portfolios are more diversified than others such as Patton's Super-Diversified Portfolios generally including more asset classes than more traditional portfolios. Generally the purpose of such presentations is to demonstrate the impact of added diversification.

Although we have done our best to present this information fairly, hypothetical performance is still potentially misleading. Hypothetical data does not represent actual performance and should not be interpreted as an indication of actual performance. This data is based on transactions that were not made. Instead, the trades were simulated, based on knowledge that was available only after the fact and thus with the benefit of hindsight. Results do not include the impact of taxes, if any. Past performance is not indicative of future performance.

Although performance analysis is precise by nature, the analysis is generally intended to provide general ideas about how different portfolio allocations compare to one another.

Please contact us with any questions and/or additional explanation.

Client Performance Reporting

Client performance reporting, illustrated as the "Family", in the password protected areas of our webiste, including our Super-Diversified Portfolio Statements section, does represent the actual performance of an individual client's portfolio. Returns are shown net of fees, deposits, and withdrawals. These returns are calculated consistent with industry standards (returns are linked for periods upon a deposit or withdrawal).

Every effort is made to insure correct calculations. Please notify Patton if you believe your returns do not appear correct.

For clients with an investment in a Patton hedge fund / L.P., all current date valuations and daily returns for hedge fund investments are an estimate. These estimates are based on your most recent actual month-end balance, if applicable, and incremented by the estimated daily percent change. Month-end market valuations are actual once the hedge fund statement has been posted to the website.

Performance for specific asset classes does NOT represent the actual performance for the client; this performance is for the asset class based on the assumptions and descriptions made in our Asset Classes Descriptions in our full disclosure.

Any reference to the "Benchmark" portfolio is a simulated portfolio. This does not represent actual returns. It is used as a simulated benchmark to compare to the client's actual performance. See the "Benchmark Portfolio" report in the Dashboard reports for details about the asset allocation and more of the Benchmark Portfolio. See our disclosure regarding hypothetical model portfolios.

Asset Classes

The following table shows the Asset Classes that are available throughout the website, the market index that is used to represent each asset class, and the estimated fee that is deducted from the performance of the index.

| Asset Class Description | Assumed Fee | Index | Index Fund | Start | End |

|---|---|---|---|---|---|

| U.S. Large-Cap | 0.095% | S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 02/28/2026 |

| Russell 1000 | 0.150% | Russell 1000 IndexThe Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index. As of 31 December 2021, the stocks of the Russell 1000 Index had a weighted average market capitalization of $608.1 billion and a median market capitalization of $15.1 billion. As of 8 May 2020, components ranged in market capitalization from $1.8 billion to $1.4 trillion.[1] The index, which was launched on January 1, 1984, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. | iShares Russell 1000 ETF (IWB) | 06/30/1988 | 02/28/2026 |

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 06/30/1988 | ||

| U.S. Large-Cap Equal Weight | 0.200% | S&P 500 Equal Weighted IndexThe S&P 500® Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight - or 0.2% of the index total at each quarterly rebalance. | n/a | 12/31/1970 | 02/28/2026 |

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1970 | ||

| U.S. Large-Cap Growth | 0.180% | Russell 1000 Growth IndexThe Russell 1000® Growth Index measures the performance of the largecap growth segment of the US equity universe. It includes those Russell 1000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years). The Russell 1000® Growth Index is constructed toprovide a comprehensive and unbiased barometer for the large-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics. | iShares Russell 1000 Growth ETF (IWF) | 12/31/1990 | 02/28/2026 |

| S&P 500 Growth IndexThe S&P 500 Growth Index is a stock index administered by Standard & Poor's-Dow Jones Indices. As its name suggests, the purpose of the index is to serve as a proxy for growth companies included in the S&P 500. The index identifies growth stocks using three factors: sales growth, the ratio of earnings change to price, and momentum. | n/a | 10/31/1985 | 12/31/1990 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 10/31/1985 | ||

| U.S. Large-Cap Value | 0.180% | Russell 1000 Value IndexThe Russell 1000® Value Index measures the performance of the largecap value segment of the US equity universe. It includes those Russell 1000 companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2 year) growth and lower sales per share historical growth (5 years). The Russell 1000® Value Index is constructed to provide a comprehensive and unbiased barometer for the large-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. | iShares Russell 1000 Value ETF (IWD) | 12/31/1990 | 02/28/2026 |

| S&P 500 Value IndexThe term S&P 500 Pure Value Index refers to a score-weighted index developed by Standard and Poor's (S&P). The index uses what it calls a "style-attractiveness-weighting scheme" and only consists of stocks within the S&P 500 Index that exhibit strong value characteristics. The index was launched in 2005 and consists of 120 constituents, the majority of which are financial services companies.The index was previously called the S&P 500/Citigroup Pure Value Index because of the relationship between Standard and Poor's, and Citigroup. | n/a | 10/31/1985 | 12/31/1990 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 10/31/1985 | ||

| U.S. Mid-Cap | 0.180% | Russell Mid-Cap IndexThe Russell Midcap® Index measures the performance of the mid-cap segment of the US equity universe. The Russell Midcap Index is a subset of the Russell 1000® Index. It includes approximately 800 of the smallest securities based on a combination of their market cap and current index membership. The Russell Midcap® Index represents approximately 27% of the total market capitalization of the Russell 1000® companies, as of the most recent reconstitution. The Russell Midcap Index is constructed to provide a comprehensive and unbiased barometer for the mid-cap segment. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true midcap opportunity set. | iShares Russell Mid-Cap ETF (IWR) | 06/30/1988 | 02/28/2026 |

| S&P 400 IndexThe S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices. The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index. | n/a | 10/31/1985 | 06/30/1988 | ||

| CRSP U.S. Stocks Deciles 6-8CRSP Cap-Based Portfolio Index data are a monthly series based on portfolios that are rebalanced quarterly. The methodology used to calculate the series differs from the CRSP Stock File Capitalization Decile Indexes.The universe includes all common stocks listed on the NYSE, NYSE MKT, and NASDAQ National Market excluding Unit Investment Trusts, Closed-End Funds, REITs, Americus Trusts, foreign stocks and American Depositary Receipts. Eligible companies with primary listings on the NYSE are ranked into equally populated deciles. The largest capitalizations in each decile serve as the breakpoints that are applied to various exchange groupings of the universe.Individual decile portfolios are created for each exchange group, the largest being in decile 1 and the smallest in decile 10. This index measures the combined performance of Deciles 6 - 8. | n/a | 06/30/1963 | 10/31/1985 | ||

| U.S. Mid-Cap Growth | 0.230% | Russell Mid-Cap Growth IndexThe Russell Midcap® Growth Index measures the performance of the midcap growth segment of the US equity universe. It includes those Russell Midcap Index companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years). The Russell Midcap® Growth Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap growth market. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true mid-cap growth market. | iShares Russell Mid-Cap Growth ETF (IWP) | 06/30/1988 | 02/28/2026 |

| S&P 400 IndexThe S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices. The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index. | n/a | 10/31/1985 | 06/30/1988 | ||

| CRSP U.S. Stocks Deciles 6-8CRSP Cap-Based Portfolio Index data are a monthly series based on portfolios that are rebalanced quarterly. The methodology used to calculate the series differs from the CRSP Stock File Capitalization Decile Indexes.The universe includes all common stocks listed on the NYSE, NYSE MKT, and NASDAQ National Market excluding Unit Investment Trusts, Closed-End Funds, REITs, Americus Trusts, foreign stocks and American Depositary Receipts. Eligible companies with primary listings on the NYSE are ranked into equally populated deciles. The largest capitalizations in each decile serve as the breakpoints that are applied to various exchange groupings of the universe.Individual decile portfolios are created for each exchange group, the largest being in decile 1 and the smallest in decile 10. This index measures the combined performance of Deciles 6 - 8. | n/a | 06/30/1963 | 10/31/1985 | ||

| U.S. Mid-Cap Value | 0.230% | Russell Mid-Cap Value IndexThe Russell Midcap® Value Index measures the performance of the midcap value segment of the US equity universe. It includes those Russell Midcap Index companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2 year) growth and lower sales per share historical growth (5 years). The Russell Midcap Value Index is constructed to provide a comprehensive and unbiased barometer of the mid-cap value market. The index is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true midcap value market. | iShares Russell Mid-Cap Value ETF (IWS) | 06/30/1988 | 02/28/2026 |

| S&P 400 IndexThe S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices. The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index. | n/a | 10/31/1985 | 06/30/1988 | ||

| CRSP U.S. Stocks Deciles 6-8CRSP Cap-Based Portfolio Index data are a monthly series based on portfolios that are rebalanced quarterly. The methodology used to calculate the series differs from the CRSP Stock File Capitalization Decile Indexes.The universe includes all common stocks listed on the NYSE, NYSE MKT, and NASDAQ National Market excluding Unit Investment Trusts, Closed-End Funds, REITs, Americus Trusts, foreign stocks and American Depositary Receipts. Eligible companies with primary listings on the NYSE are ranked into equally populated deciles. The largest capitalizations in each decile serve as the breakpoints that are applied to various exchange groupings of the universe.Individual decile portfolios are created for each exchange group, the largest being in decile 1 and the smallest in decile 10. This index measures the combined performance of Deciles 6 - 8. | n/a | 06/30/1963 | 10/31/1985 | ||

| U.S. Small-Cap | 0.190% | Russell 2000 IndexThe term Russell 2000 Index refers to a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London's FTSE Russell Group and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. | iShares Russell 2000 ETF (IWM) | 12/31/1978 | 02/28/2026 |

| CRSP U.S. Stocks Deciles 0-5CRSP Cap-Based Portfolio Index data are a monthly series based on portfolios that are rebalanced quarterly. The methodology used to calculate the series differs from the CRSP Stock File Capitalization Decile Indexes. The universe includes all common stocks listed on the NYSE, NYSE MKT, and NASDAQ National Market excluding Unit Investment Trusts, Closed-End Funds, REITs, Americus Trusts, foreign stocks and American Depositary Receipts. Eligible companies with primary listings on the NYSE are ranked into equally populated deciles. The largest capitalizations in each decile serve as the breakpoints that are applied to various exchange groupings of the universe. Individual decile portfolios are created for each exchange group, the largest being in decile 1 and the smallest in decile 10. This index measures the combined performance of Deciles 0 - 5. | n/a | 06/30/1963 | 12/31/1978 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 06/30/1963 | ||

| U.S. Small-Cap Growth | 0.240% | Russell 2000 Growth IndexThe Russell 2000® Growth Index measures the performance of the smallcap growth segment of the US equity universe. It includes those Russell 2000 companies with relatively higher price-to-book ratios, higher I/B/E/S forecast medium term (2 year) growth and higher sales per share historical growth (5 years). The Russell 2000 Growth Index is constructed to provide a comprehensive and unbiased barometer for the small-cap growth segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics. | iShares Russell 2000 Growth ETF (IWO) | 06/30/1988 | 02/28/2026 |

| Russell 2000 IndexThe term Russell 2000 Index refers to a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London's FTSE Russell Group and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. | iShares Russell 2000 ETF (IWM) | 12/31/1978 | 06/30/1988 | ||

| CRSP U.S. Stocks Deciles 0-5CRSP Cap-Based Portfolio Index data are a monthly series based on portfolios that are rebalanced quarterly. The methodology used to calculate the series differs from the CRSP Stock File Capitalization Decile Indexes. The universe includes all common stocks listed on the NYSE, NYSE MKT, and NASDAQ National Market excluding Unit Investment Trusts, Closed-End Funds, REITs, Americus Trusts, foreign stocks and American Depositary Receipts. Eligible companies with primary listings on the NYSE are ranked into equally populated deciles. The largest capitalizations in each decile serve as the breakpoints that are applied to various exchange groupings of the universe. Individual decile portfolios are created for each exchange group, the largest being in decile 1 and the smallest in decile 10. This index measures the combined performance of Deciles 0 - 5. | n/a | 06/30/1963 | 12/31/1978 | ||

| Dow Industrials | 0.160% | Dow Jones Industrial IndexThe Dow Jones® Industrial AverageSM (DJIA) is composed of thirty (30) “blue-chip” U.S. stocks. At 100-plus years, it is the oldest continuing U.S. market index. The DJIA has evolved into the most recognizable stock indicator in the world, and the only index composed of companies that have sustained earnings performance over a significant period of time.It is a price-weighted measurement stock market index of 30 prominent (Blue Chip) companies listed on stock exchanges in the United States. | n/a | 06/30/1963 | 02/28/2026 |

| U.S. Small-Cap Value | 0.240% | Russell 2000 Value IndexThe Russell 2000® Value Index measures the performance of the smallcap value segment of the US equity universe. It includes those Russell 2000 companies with relatively lower price-to-book ratios, lower I/B/E/S forecast medium term (2 year) growth and lower sales per share historical growth (5 years). The Russell 2000 Value Index is constructed to provide a comprehensive and unbiased barometer for the small-cap value segment. The index is completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect value characteristics. | iShares Russell 2000 Value ETF (IWN) | 06/30/1988 | 02/28/2026 |

| Russell 2000 IndexThe term Russell 2000 Index refers to a stock market index that measures the performance of the 2,000 smaller companies included in the Russell 3000 Index. The Russell 2000 is managed by London's FTSE Russell Group and is widely regarded as a bellwether of the U.S. economy because of its focus on smaller companies that focus on the U.S. market. | iShares Russell 2000 ETF (IWM) | 12/31/1978 | 06/30/1988 | ||

| CRSP U.S. Stocks Deciles 0-5CRSP Cap-Based Portfolio Index data are a monthly series based on portfolios that are rebalanced quarterly. The methodology used to calculate the series differs from the CRSP Stock File Capitalization Decile Indexes. The universe includes all common stocks listed on the NYSE, NYSE MKT, and NASDAQ National Market excluding Unit Investment Trusts, Closed-End Funds, REITs, Americus Trusts, foreign stocks and American Depositary Receipts. Eligible companies with primary listings on the NYSE are ranked into equally populated deciles. The largest capitalizations in each decile serve as the breakpoints that are applied to various exchange groupings of the universe. Individual decile portfolios are created for each exchange group, the largest being in decile 1 and the smallest in decile 10. This index measures the combined performance of Deciles 0 - 5. | n/a | 06/30/1963 | 12/31/1978 | ||

| U.S. Micro-Cap | 0.600% | Wilshire US Micro-Cap IndexThe term Wilshire US Micro Cap Index refers to a composite that includes micro capitalization companies located in the United States. The Wilshire US Micro Cap is published and maintained by Wilshire Associates. | iShares Micro-Cap ETF (IWC) | 06/30/1963 | 02/28/2026 |

| NASDAQ Composite | 0.210% | NASDAQ Composite IndexThe Nasdaq Composite Index uses a market capitalization weighting methodology. The index's value equals the total value of the share weights of each of the constituent securities, multiplied by each security's last price.It seeks to provide investment returns that closely correspond to the price and yield performance of the Nasdaq Composite Index (Index). | n/a | 01/31/1971 | 02/28/2026 |

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 01/31/1971 | ||

| NASDAQ 100 | 0.180% | NASDAQ 100 IndexThe NASDAQ 100 Index Fund seeks to track the investment results, before fees and expenses, of the NASDAQ-100 Index® which includes 100 of the largest Nasdaq-listed non-financial companies. | Invesco QQQ Trust (QQQ) | 10/31/1985 | 02/28/2026 |

| NASDAQ Composite IndexThe Nasdaq Composite Index uses a market capitalization weighting methodology. The index's value equals the total value of the share weights of each of the constituent securities, multiplied by each security's last price.It seeks to provide investment returns that closely correspond to the price and yield performance of the Nasdaq Composite Index (Index). | n/a | 01/31/1971 | 10/31/1985 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 01/31/1971 | ||

| S&P 500 Growth | 0.040% | S&P 500 Growth IndexThe S&P 500 Growth Index is a stock index administered by Standard & Poor's-Dow Jones Indices. As its name suggests, the purpose of the index is to serve as a proxy for growth companies included in the S&P 500. The index identifies growth stocks using three factors: sales growth, the ratio of earnings change to price, and momentum. | n/a | 10/31/1985 | 02/28/2026 |

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 10/31/1985 | ||

| S&P 500 Value | 0.040% | S&P 500 Value IndexThe term S&P 500 Pure Value Index refers to a score-weighted index developed by Standard and Poor's (S&P). The index uses what it calls a "style-attractiveness-weighting scheme" and only consists of stocks within the S&P 500 Index that exhibit strong value characteristics. The index was launched in 2005 and consists of 120 constituents, the majority of which are financial services companies.The index was previously called the S&P 500/Citigroup Pure Value Index because of the relationship between Standard and Poor's, and Citigroup. | n/a | 10/31/1985 | 02/28/2026 |

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 10/31/1985 | ||

| S&P 400 Mid | 0.230% | S&P 400 IndexThe S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices. The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index. | n/a | 10/31/1985 | 02/28/2026 |

| CRSP U.S. Stocks Deciles 6-8CRSP Cap-Based Portfolio Index data are a monthly series based on portfolios that are rebalanced quarterly. The methodology used to calculate the series differs from the CRSP Stock File Capitalization Decile Indexes.The universe includes all common stocks listed on the NYSE, NYSE MKT, and NASDAQ National Market excluding Unit Investment Trusts, Closed-End Funds, REITs, Americus Trusts, foreign stocks and American Depositary Receipts. Eligible companies with primary listings on the NYSE are ranked into equally populated deciles. The largest capitalizations in each decile serve as the breakpoints that are applied to various exchange groupings of the universe.Individual decile portfolios are created for each exchange group, the largest being in decile 1 and the smallest in decile 10. This index measures the combined performance of Deciles 6 - 8. | n/a | 06/30/1963 | 10/31/1985 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 06/30/1963 | ||

| U.S. All-Cap | 0.030% | CRSP U.S. Total Market IndexThe investment seeks to track the performance of the CRSP US Total Market Index that measures the investment return of the overall stock market.Nearly 4,000 constituents across mega, large, small and micro capitalizations, representing nearly 100% of the U.S. investable equity market, comprise the CRSP US Total Market Index. The total return index was first posted on the NASDAQ GIDSSM (Global Index Data ServiceSM) feed on December 31, 2012; the price return index was posted on January 18, 2011. | Vanguard Total Stock Market ETF (VTI) | 12/31/1985 | 02/28/2026 |

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1985 | ||

| Intl Developed Countries | 0.030% | MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 02/28/2026 |

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Intl Core | 0.070% | MSCI ACWI ex USAThe MSCI ACWI ex USA Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 24 Emerging Markets (EM) countries*. With 2,271 constituents, the index covers approximately 85% of the global equity opportunity set outside the US. | iShares Core MSCI Total Intl Stk ETF (IXUS) | 10/31/2012 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 10/31/2012 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Intl Growth | 0.340% | MSCI EAFE Growth IndexThe MSCI EAFE Growth Index captures large and mid cap securities exhibiting overall growth style characteristics acrossDeveloped Markets countries* around the world, excluding the US and Canada. The growth investment style characteristics forindex construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate,current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend. | iShares MSCI EAFE Growth ETF (EFG) | 08/31/2005 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 08/31/2005 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Intl Value | 0.310% | MSCI EAFE Value IndexThe MSCI EAFE Value Index captures large and mid cap securities exhibiting overall value style characteristics across Developed Markets countries* around the world, excluding the US and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. With 461 constituents, the index targets 50% coverage of the free float-adjusted market capitalization of the MSCI EAFE Index.The MSCI EAFE Value Index captures large and mid cap securities exhibiting overall value style characteristics across Developed Markets countries* around the world, excluding the US and Canada. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield. | iShares MSCI EAFE Value ETF (EFV) | 08/31/2005 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 08/31/2005 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Intl Developed Small-Cap | 0.400% | MSCI EAFE Small Cap IndexThe MSCI EAFE Small Cap Index is an equity index which captures small cap representation across Developed Markets countries* around the world, excluding the US and Canada. With 2,329 constituents, the index covers approximately 14% of the free floatadjusted market capitalization in each country."The MSCI EAFE Small Cap Index is an equity index which captures small cap representation across Developed Markets countries*around the world, excluding the US and Canada. With 2,387 constituents, the index covers approximately 14% of the free float adjusted market capitalization in each country." | iShares MSCI EAFE Small-Cap ETF (SCZ) | 12/31/1992 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 12/31/1992 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Intl Emerging Countries | 0.070% | FTSE Emerging Markets All Cap China A InclusionThe FTSE Emerging Markets All Cap China A Inclusion Index is a market-capitalisation weighted index representing the performance of large, mid and small cap stocks in Emerging markets. The index is part of the FTSE China A Inclusion Indexes which contain FTSE China A All Cap Index securities adjusted for the aggregate approved QFII and RQFII quotas available to international investors. | Vanguard FTSE Emerging Markets ETF (VWO) | 12/31/1987 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 12/31/1987 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Intl Emerging Small-Cap | 0.650% | S&P Emerging Markets Under USD2 Billion IndexThe S&P Emerging Under USD2 Billion is a float-adjusted market capitalization weighted index including all stocks with total market capitalization less than USD 2 Billion from emerging countries included in the S&P Emerging BMI. | State Street SPDR S&P EM Sm Cp ETF (EWX) | 05/31/2008 | 02/28/2026 |

| FTSE Emerging Markets All Cap China A InclusionThe FTSE Emerging Markets All Cap China A Inclusion Index is a market-capitalisation weighted index representing the performance of large, mid and small cap stocks in Emerging markets. The index is part of the FTSE China A Inclusion Indexes which contain FTSE China A All Cap Index securities adjusted for the aggregate approved QFII and RQFII quotas available to international investors. | Vanguard FTSE Emerging Markets ETF (VWO) | 12/31/1987 | 05/31/2008 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1987 | ||

| Total World | 0.060% | FTSE Global All Cap IndexThe FTSE Global All Cap Index is a market-capitalisation weighted index representing the performance of the large, mid and small cap stocks globally. | Vanguard Total World Stock ETF (VT) | 06/30/2008 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 06/30/2008 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Region - Eurozone | 0.500% | MSCI EMUThe MSCI EMU Index (European Economic and Monetary Union) captures large and mid cap representation across the 10 Developed Markets countries in the EMU*. With 230 constituents, the index covers approximately 85% of the free float-adjusted market capitalization of the EMU.The MSCI EMU Index (European Economic and Monetary Union) captures large and mid cap representation across the 10 Developed Markets countries in the EMU*. With 233 constituents, the index covers approximately 85% of the free float-adjusted market capitalization of the EMU. | iShares MSCI Eurozone ETF (EZU) | 07/31/2000 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 07/31/2000 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Region - Asia | 0.490% | MSCI AC Asia | State Street SPDR S&P Em AsiaPac ETF (GMF) | 03/31/2007 | 02/28/2026 |

| FTSE Emerging Markets All Cap China A InclusionThe FTSE Emerging Markets All Cap China A Inclusion Index is a market-capitalisation weighted index representing the performance of large, mid and small cap stocks in Emerging markets. The index is part of the FTSE China A Inclusion Indexes which contain FTSE China A All Cap Index securities adjusted for the aggregate approved QFII and RQFII quotas available to international investors. | Vanguard FTSE Emerging Markets ETF (VWO) | 12/31/1987 | 03/31/2007 | ||

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 12/31/1987 | ||

| Country - Australia | 0.500% | MSCI AustraliaThe MSCI Australia Index is designed to measure the performance of the large and mid cap segments of the Australia market. With 66 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in Australia. | iShares MSCI Australia ETF (EWA) | 03/31/1996 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 03/31/1996 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Country - Germany | 0.490% | MSCI GermanyThe MSCI Germany Index is designed to measure the performance of the large and mid cap segments of the German market. With 60 constituents, the index covers about 85% of the equity universe in Germany. | iShares MSCI Germany ETF (EWG) | 03/31/1996 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 03/31/1996 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Country - France | 0.500% | MSCI FranceThe MSCI France Index is designed to measure the performance of the large and mid cap segments of the French market. With 65 constituents, the index covers about 85% of the equity universe in France. | iShares MSCI France ETF (EWQ) | 03/31/1996 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 03/31/1996 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Country - United Kingdom | 0.500% | MSCI United KingdomThe MSCI United Kingdom Index is designed to measure the performance of the large and mid cap segments of the UK market. With 82 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in the UK. | iShares MSCI United Kingdom ETF (EWU) | 03/31/1996 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 03/31/1996 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Country - Italy | 0.500% | MSCI Italy 25/50The MSCI Italy 25/50 Index is designed to measure the performance of the large and mid cap segments of the Italian market. It applies certain investment limits that are imposed on regulated investment companies, or RICs, under the current US Internal Revenue Code. With 24 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in Italy.The MSCI Italy 25/50 Index is designed to measure the performance of the large and mid cap segments of the Italian market. It applies certain investment limits that are imposed on regulated investment companies, or RICs, under the current US Internal Revenue Code. With 26 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in Italy. | iShares MSCI Italy ETF (EWI) | 03/31/1996 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 03/31/1996 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Country - Spain | 0.500% | MSCI Spain 25/50The MSCI Spain 25/50 Index is designed to measure the performance of the large and mid cap segments of the Spanish market. It applies certain investment limits that are imposed on regulated investment companies, or RICs, under the current US Internal Revenue Code. With 19 constituents,the index covers approximately 85% ofthe free float-adjusted market capitalization in Spain. | iShares MSCI Spain ETF (EWP) | 03/31/1996 | 02/28/2026 |

| MSCI EAFE IndexThe MSCI EAFE Investable Market Index (IMI) is an equity index which captures large, mid and small cap companies and targets coverage of approximately 99% of the global equity opportunity set outside the US and Canada. The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries* around the world, excluding the US and Canada. The index is comprehensive, covering approximately 85% of the free float-adjusted market capitalization in each country."The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries*around the world, excluding the US and Canada. With 843 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country." | Vanguard FTSE Developed Markets ETF (VEA) | 12/31/1969 | 03/31/1996 | ||

| S&P 500 IndexThe Standard and Poor's 500, or simply the S&P 500,[5] is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. | State Street SPDR S&P 500 ETF (SPY) | 06/30/1963 | 12/31/1969 | ||

| Country - China | 0.730% | FTSE China 50 IndexThe FTSE China 50 Index is designed to represent the performance of Chinese companies that are listed on the Hong Kong Stock Exchange. H Shares, P Chips and Red Chips are eligible for inclusion in the FTSE China 50 Index. Other China share classes are ineligible | iShares China Large-Cap ETF (FXI) | 10/31/2004 | 02/28/2026 |

| FTSE Emerging Markets All Cap China A InclusionThe FTSE Emerging Markets All Cap China A Inclusion Index is a market-capitalisation weighted index representing the performance of large, mid and small cap stocks in Emerging markets. The index is part of the FTSE China A Inclusion Indexes which contain FTSE China A All Cap Index securities adjusted for the aggregate approved QFII and RQFII quotas available to international investors. | Vanguard FTSE Emerging Markets ETF (VWO) | 12/31/1987 | 10/31/2004 | ||